Price Action Strategy is a market analysis procedure through historical price movements (Low, High, Open, Close) to assist you in making more robust trading judgments. The price action strategy for stocks is popular with retail traders, arbitrageurs, speculators, and institutional traders & is a form of technical analysis (TA).

Price Action Strategy: Concept

Some retail investors make decisions based on the price movement of assets. This is the foundation of trade action prices – keeping an eye on the price movements & entering the market when they think is the most profitable.

Price action investors do not use technical indicators such as Bollinger Bands or Moving Average, but if you do it, you have to give them less importance in trade decisions. They believe that good reliable information only comes from the price line and its movements.

Price Action Strategy: Focus

This strategy’s main focus is on the change in the price section. Price gives traders a good insight into the psychology of the market. PA tells you what is going on in the market. Before we jump into price action strategy, first understand some basics of it. There are four pillars of price action strategy that hold it. These are:

Pillars of Price Action Strategy

- Candlesticks

- Flat Market

- Bullish Trend

- Bearish Trend

- Candlesticks Candlesticks are an essential pillar of price action strategy. Candlesticks are more comfortable and more appealing to understand.

- Flat Market When there is no movement in the market for a certain period, that time is known as a flat trend.

- Bullish Trend The bull market indicates a rising price. A bullish trend is a signal that the price of an asset will rise.

- Bearish Trend Bearish trend is the exact opposite of the bullish trend, which means the price of an asset will fall.

Price Action Trading Strategies: How to Use?

The way to a successful price action stock trading strategy is to forget the fundamental data and just focus on the price patterns. If used correctly, this could be the best successful investment strategy.

- Support and Resistance Levels The chart analysis can turn in a comparatively brief time. One of the main aspects of price action trading is when using resistance and support levels; the fact is that once a support/resistance level is crossed, it can then turn into resistance/support and vice versa. It is having no value when traders start to focus on tense periods for commodity or contract prices; the vast majority of the time, they begin to trade lateral markets—all within a comparatively fair range.

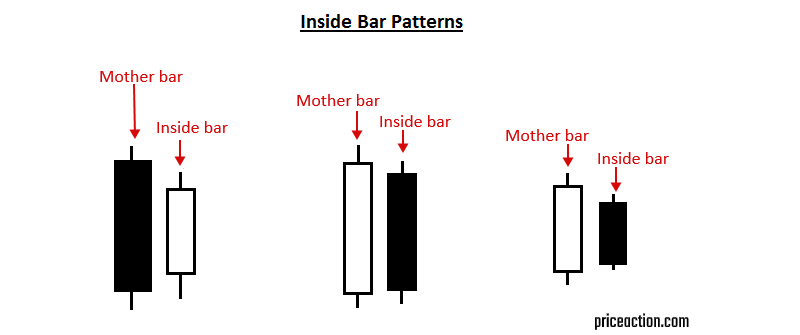

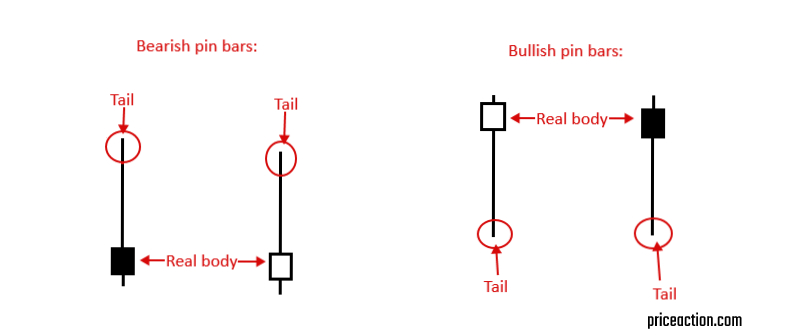

- Inside Bar Patterns You can easily remember these patterns by the exposure of a subordinate bar within the body of the previous bar. Never forget to observe the stop-loss limit. The main bar is known as the mother bar sometimes. Side by side, two inside bars is an even more robust signal.

- Inside Bar and Pin Bar Combo Many price action investors are exceptionally sharp-eyed as they precisely recognize it in time and result in lucrative opportunities. A primary inside bar and pin bar combo is a good indication. Apart from this sign, when you also see the inside bar shape near or within the pin bar nose, that is a more vital sign. Those who manage to learn these patterns will be able to set up some profit-making trades. One inside bar/mother bar occurrence is cheering.

Benefits of Price Action Strategy for Stocks

- Price action trading is an easy way to trade.

- It is easy to understand signals through price action trading.

- It is a time tested strategy.

- Price action analysis not only works in stock trading but also in all market variables.

- No foggy methods, just clearly defined entries.

- It helps traders to achieve the discipline that is required in stock trading.

- Much more profitable outcomes out of higher time frames

- It is easy to test the price action strategy on demo accounts.

- With trading, price action strategy works better in range-bound conditions.

- Traders get relevant market perspectives through PA.

Disadvantages of Price Action Trading Strategy

- Less number of trades.

- Need to wait for your levels

- Poor placements of stops.

- Size of a candlestick reversal pattern.

- If you are barely patient, the chances of you making money are lower.

- Relies heavily on a statistical analysis of patterns

- Lots of ad-hoc methods are used to identify targets and stop loss for your trades.

- Definite changes in trends.

- No fundamental analysis

- It is very tough to trade entirely on price.

Price Action Strategy for Stocks: Last Call

So, this was all about price action strategy for stocks. Note that how this price action will work for you depends upon you. It could be as easy as pie and robust as you want and as complicated as you make it. Now, if you have tied your laces to apply all your knowledge that you gained about price action strategy, then ensure choosing a suitable broker only. Some of the top brokers in India are Zerodha, Upstox, Angel Broking, and 5paisa.