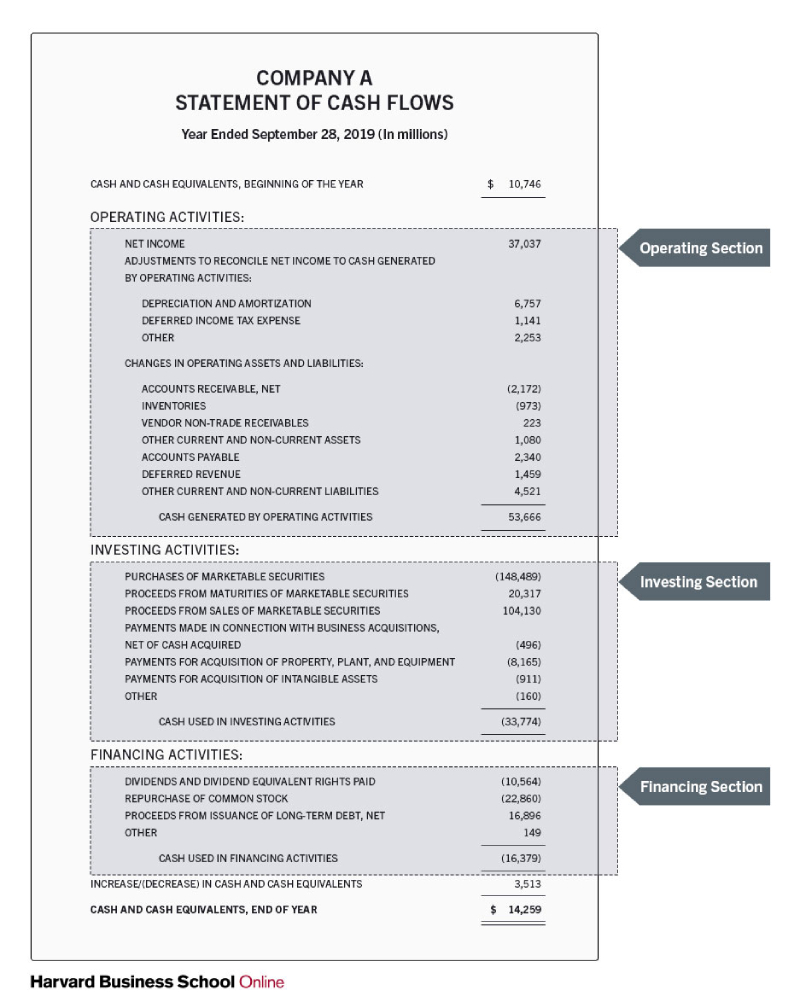

Cash flow is the flow of funds into and out of your business's bank account from operations, financing, and investing. In simple words, Cash Flow is calculated by comparing how much money comes into firm compared to how much money flows out within the same time period. Cash flow is usually calculated over the period of a month or quarter.

In this article, we will understand some basic details about cash flows and why it is so important for keeping up the business.

Cash Flow: Importance in Businesses

Cash Flow: Importance in Businesses

Cash Flow Statements helps in understanding exactly how much money you have at any particular time. This is critical since all of your plans and decisions must be based on reliable data. If you don't carefully manage your cash flow, you risk making poor judgments that put your company at risk.

Although you may believe that your company is doing well, a cash flow statement may reveal that there isn't much money flowing in that specific month.

If you efficiently manage your cash flow, you'll acquire a greater grasp of where you're currently spending your money, which isn't visible on a profit and loss statement. It's critical to understand where and why your money is being spent.

It's not always easy to notice expenses in black and white, which is why it's critical to keep track of your cash flow. You might be able to uncover cost-cutting opportunities in your company.

If you're facing cash flow issues, you might not be able to pay your suppliers & employees because you don't have enough money. This could jeopardize your commercial relationship with them as well as your overall reputation.

Establish payment schedules to guarantee that you have the funds to pay your vendors. It's critical to plan ahead of time so you don't find yourself with many invoices or bills to deal with at the same time.

It's exciting to see your company grow and flourish. Growth in a business necessitates a large sum of money & before money starts flowing in there are a lot of expenses. It could be office rent, employee salaries, buying assets, or anything else. You'll have troubles if you don't have the money to match your expansion.

Although cash flow issue is common, it can be avoided through the following ways:

So, this was all about Cash flows. One easy & straightforward way to calculate it is comparing your total outstanding purchases to the total sales due at the end of each month. If your total unpaid purchases exceed your total sales due, you'll need to spend more money in the coming month than you'll receive, signaling a possible cash-flow concern.

Latest Updates from around the world

Most read stories, topics, and videos

Latest Updates from around the world