India is a favourable market for all businesses. It supports various conditions and is very suitable when it comes to startups. Recently around 10 Indian startup companies got unicorn status which shows the strength of the Indian market.

FinTech in India is in boom and, the government’s dream of ‘Digital India’ is helping them a lot. The demonetization drive in 2016 also helped in the growth of these companies.

Cashfree is a FinTech and Digital Payments Startup company. The company was founded just a year before the demonetization drive, that is, in 2015. It helps in sending and accepting money; in short, it is a full-stack payment solution.

Finance and Technology are two main pillars of the Indian economy and, startups like these help the country grow. Such companies got overnight limelight and success after the demonetization and, since then, there is no looking back for them.

Cashfree Startup Story - Key PointsAkash Sinha (CEO), an IIIT-H (International Institue of InformationTechnology, Hyderabad) graduate and an ex-Amazon employee, is the founder. He has a background in tech and has also worked with a FinTech company before.

RajuDutta, an IIT-K (Indian Institute of Technology, Kharagpur), is the co-founder. Raju has worked for an e-commerce website before as a marketing head. He also has a vast knowledge of digital marketing.

Both of them got introduced by a mutual friend. They further became good friends and shared the same idea. It ultimately leads to the building of this company.

Cashfree, as the name suggests, makes cash transfer easier for businesses and individuals.

The company’s Logo is in simple blue colour, which signifies trust, positivity, and loyalty.

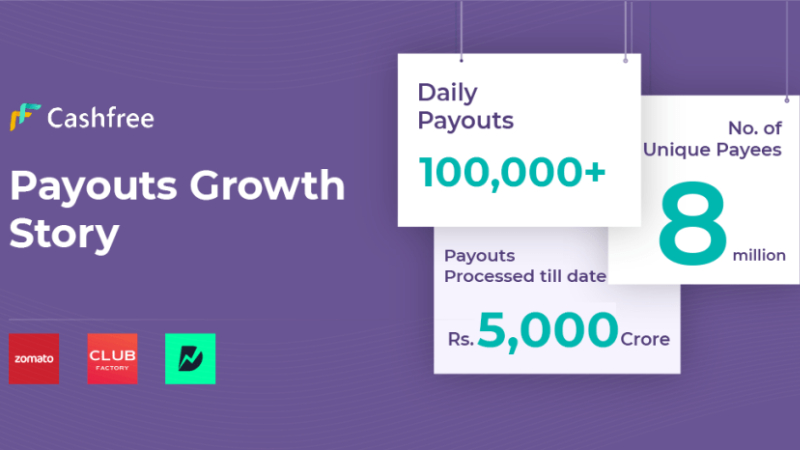

The app offers a platform for digital payments. It is a payment solution that eases the mode of sending and receiving money. It is used by 50,000 plus individuals and businesses daily for money transfer, wage payment, refunds, vendor payouts, etc. The company charges a fee of anywhere around 1.5% to 3% of the value of proceedings.

The company also has a strategy of customer retention as they minimize the difficulties caused during the payments. It has a high success rate and has also helped the company gain the trust of its clients and customers.

Cashfree is around six years old startup company, and in this short period, the company has raised a good amount of funding.

In total, the company has been successful in raising 42.5 million dollars. The investments have helped the company to work towards its vision. They are planning to create a dynamic base in India and emerge into several markets.

Competitions are a big part of our lives. When it comes to startups, the challenges are never-ending. One of the biggest challenges for entrepreneurs is to face their competitors. Some of the powerful competitors of this FinTech startup are:

Cashfree is used by over 50,000 plus people including, businesses, vendors, etc. It is an instant money transfer app and one of India’s leading API banking platforms. It provides various services to its clients/customers. Some of those are:

Cashfree is one of the leading FinTech companies in India. Several people and businesses used this app. Some of its main clients are BigBasket, Delhivery, Cred, Zomato, ZoomCar, etc. It also supports several e-commerce websites such as Vero Moda, Nykaa, EaseMyTrip, etc.

The revenue of this company in 2020 was 100 crores and, the company was able to make a profit of 20 crores. In the financial year 2020-21, the company plans to grow by 2-2.5 times in volume and revenue.

The company is currently dealing with millions of transactions per day. Also, they are planning to handle around 5 million transactions by the end of this year. Apart from Bangalore, they have their offices in Mumbai, Delhi, and Chennai.

Startups and entrepreneurs have to face a lot of challenges to survive and grow. Some of the difficulties and challenges in their path are:

Cashfree is a perfect example of an ideal and successful startup story. The company has gained a lot of recognition and respect in just six years. With a lot of competitors and challenges, the company has still managed to survive. It is an inspiration for all those who are planning to step into the FinTech industry in India. If you are passionate and confident about your idea, you can achieve anything you want.

Latest Updates from around the world

Most read stories, topics, and videos

Latest Updates from around the world